Welcome to the Wild World of 0DTE

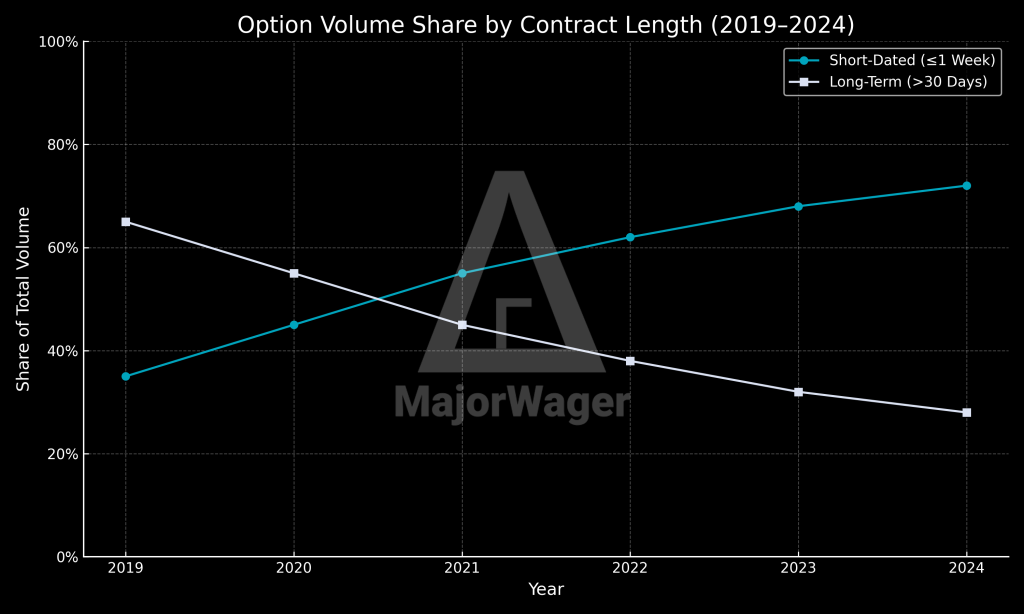

Imagine a financial instrument that explodes in popularity fivefold in just three years, goes from obscure curiosity to half the entire SPX options market, and casually tosses around a trillion in notional volume every single day. Enter: the 0DTE (Zero-Day-To-Expiration) option. It’s like the espresso shot of derivatives; quick, potent, and not for the faint of heart.

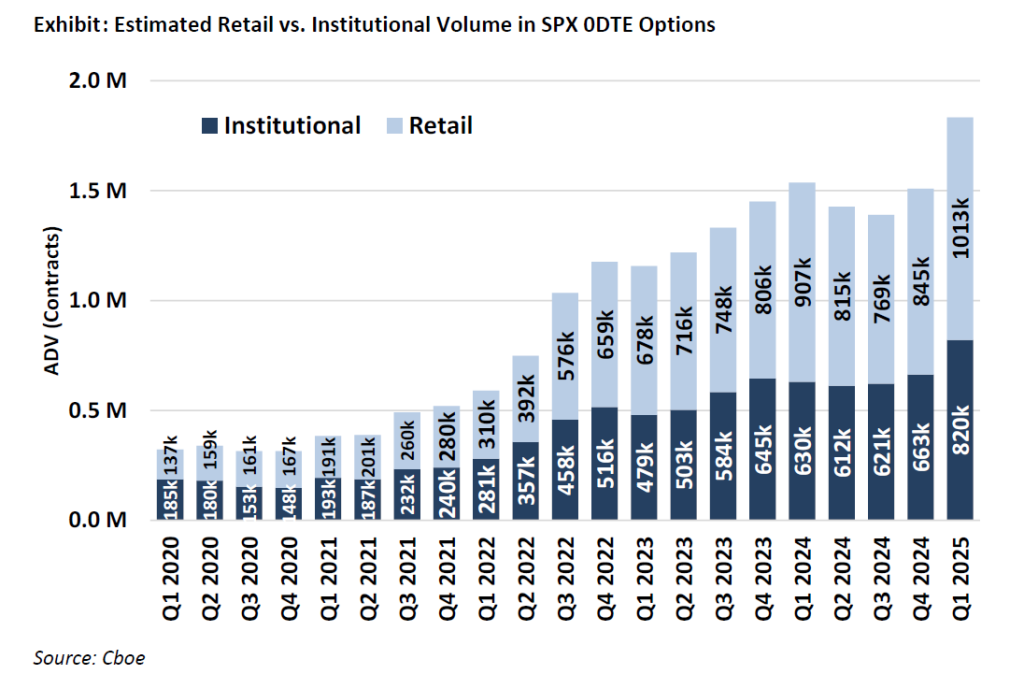

Exhibit A: SPX 0DTE ADV rocket-launched from 388,000 contracts in Q1 2022 to nearly 2 million in Q1 2025 – a fivefold surge that would make even meme stocks blush.

This is the stuff of legends; and probably ulcers. The rise of 0DTEs has blurred the line between tactical precision and full-blown degeneracy. So what’s going on behind the scenes?

Retail vs. Institutions: The Turf War

Retail is no longer just “dumb money” punting meme stocks. In fact, 0DTE trading is about half retail. And yes, that includes Uncle Joe on Robinhood, who just discovered iron condors last week.

According to Cboe’s spicy breakdown:

- Retail ADV: up 7x since 2020

- Institutional ADV: up 4x in the same timeframe

- Net result? Retail now commands 55% of the 0DTE volume, up from 42% just five years ago.

Chart: Retail vs. Institutional ADV in SPX 0DTE (2020-2025)

But not all 0DTEs are created equal. Institutions prefer to fire early and disappear by lunchtime (18% of trades in the first 30 minutes), while retail traders tend to U-turn back into the market in the last half hour—classic YOLO behavior.

Strategies: Who’s Doing What?

Here’s the menu:

| Strategy | Retail % | Institutional % |

|---|---|---|

| Outright Calls/Puts | 51.9% | 50.2% |

| Vertical Spreads | 27.6% | 33.4% |

| Iron Condors | 7.7% | 4.1% |

| Butterflies | 3.5% | 1.0% |

Retail leans on tight spreads and low risk exposure. Over half of retail trades risk less than $2K. Institutions? Sixty percent of their trades risk over $20K. And 27% swing with max losses over $100K.

That’s not trading. That’s dueling with bazookas.

Volatility: When Tariffs Drop, 0DTEs Duck

During the April tariff chaos, SPX volatility spiked to 2008 GFC levels. VIX soared, and 0DTE volume dropped like a stone; from 64% to 36% share of SPX options.

Retail bailed. Their share dropped from 57% to 47% in under 10 days. Institutions, immune to panic and armed with delta hedges, stepped in. You can almost hear them whispering, “We are the volatility.”

Mythbusting: Are 0DTEs Wrecking the Market?

Short answer: No. Not even close.

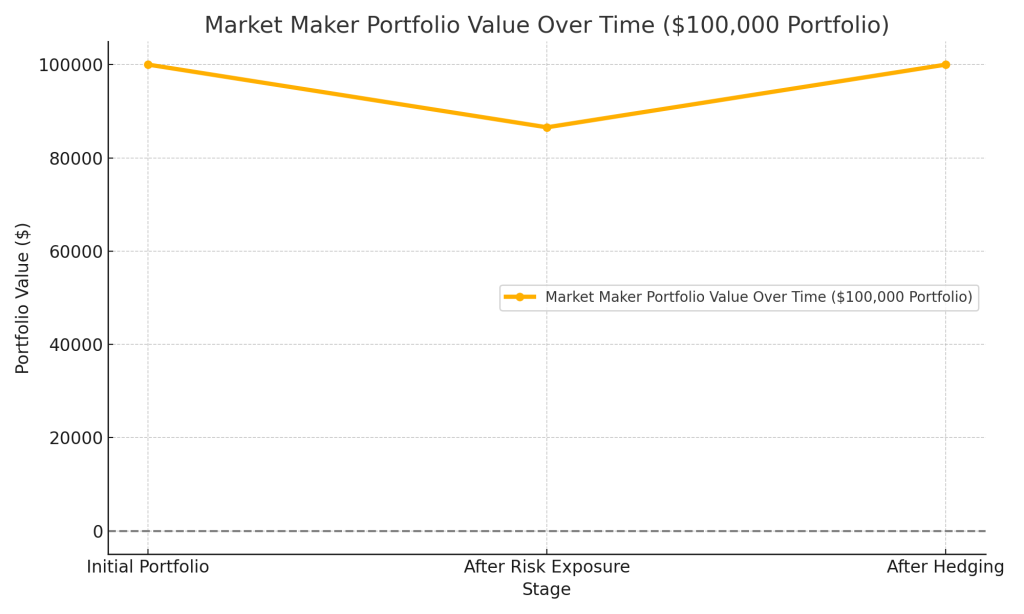

Though $1 trillion notional trades daily, net gamma exposure is surprisingly tame. On volatile days like April 4 and April 9, market makers were mostly long gamma meaning they dampened volatility.

Example: On April 4, when SPX dropped 6%, market makers had net gamma from +$2.1B to -$390M. The hedging effect? Measured. Controlled. Hardly panic-worthy.

Compare that to the SPX futures market, which cleared $850B–$940B in volume those days. Gamma-related hedging from 0DTEs was barely 0.2% of that.

Conclusion? The tail is not wagging the dog. The tail is just chasing yield.

Major Takeaways for Retail Traders:

- 0DTEs are booming but risk control is key.

- Institutions open fast, retail closes late.

- Stay away during volatility spikes unless you really know what you’re doing.

- Market makers are not destroying markets with gamma; stop blaming them for your blown stop loss.

At MajorWager, we track where and when real whales are trading – volume, delta, gamma exposure, and institutional footprints. Let them play their games. We’ll play ours and smarter now.

Inside Edge. Zero Hedge.