Retail Raiders, Whale Trackers, and the Dawn Patrol of SPX Trading

If you’ve ever felt that the market was moving faster than your chart could refresh, congrats! You’re living in the 0DTE era.

Let’s be clear: 0DTE (Zero Days to Expiry) options are no longer a niche. They’re the main act, the frontman, the lead guitarist, the encore, and sometimes… the rug pull. In Cboe’s latest whitepaper, we got the receipts- and yes, it’s exactly what you thought. The degens are winning. Or at least, they’re showing up loud.

The 0DTE Explosion: From Side Show to Main Stage

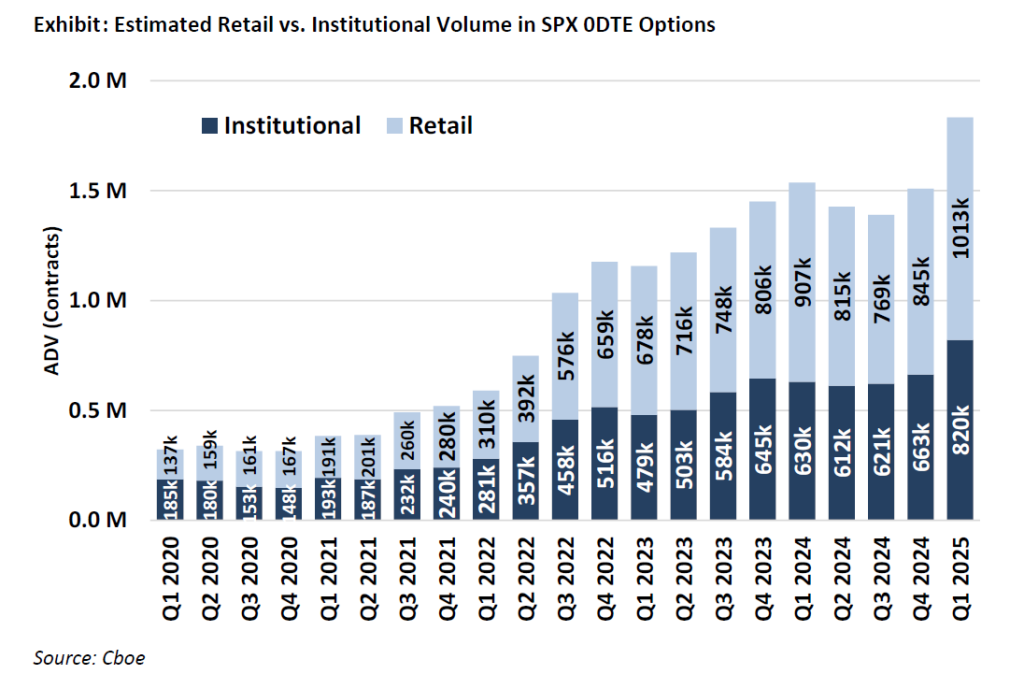

According to data from CBOE, In 2019, 0DTE SPX contracts were just 11% of volume. Fast-forward to today, and they’ve ballooned to 54%. That’s not a trend, that’s a takeover.

And don’t blame the quants just yet, retail is driving the party bus. Commissions hit zero, Robinhood went viral, and Reddit got a Bloomberg Terminal (sort of). What happened next? Retail broker ADV (average daily volume) doubled from ~15 million to 30 million contracts post-COVID.

Pandemic hobbies, meet leverage.

Why Traders Love 0DTE

Cboe breaks it down, but let’s cut the academic fat. Here’s the real reason 0DTE contracts are attractive:

- High leverage, low premium. Translation: “I can lose $200 fast, but maybe I triple it first.”

- Tight timeframes. You win or lose today. No waiting, no theta bleed anxiety.

- Clean setups. Retail and algos love the simplicity of playing “will it break or bounce… by 4PM?”

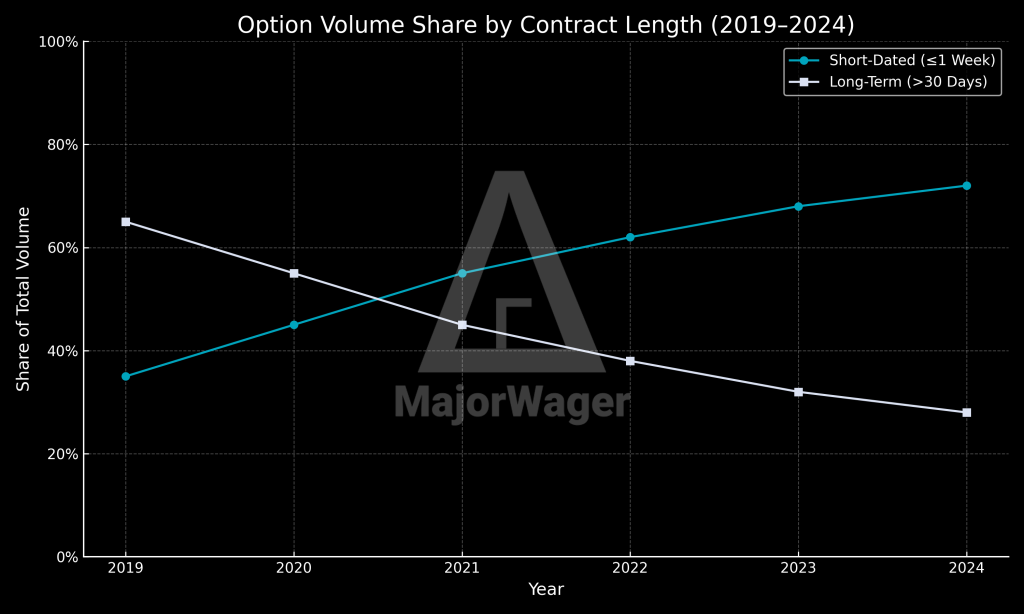

Versus the Long-Dated Dinosaurs

Remember when people bought options with expirations more than 30 days out? That’s ancient history.

Chart after chart shows long-dated contracts have been left in the dust. Once the majority of the flow (65% in 2019), they now account for just 25%.

Meanwhile, same-day traders have shown up in force, and they’re doing something else surprising:

The Put/Call Ratio Is Flat

Old-school SPX flow was all about hedging; puts galore. But not in the 0DTE streets. Calls and puts are roughly even, meaning this isn’t protection. This is speculation. And probably some YOLO.

Execution Patterns: Rise of the Minions

Cboe data shows the average trade size for 0DTEs is under 4 contracts. That’s a retail footprint.

This isn’t Goldman or Citadel slamming thousands of contracts, this is a swarm of smaller accounts placing surgical bets. Add to that:

- 97% of 0DTE trades are electronic

- Most of it happens in the first hour or last two hours of the day

MajorWager users already know: When the Big Players move, we see them.

What to Know

| Stat | 2019 | 2025 (Q1) |

|---|---|---|

| 0DTE share of SPX | 11% | 54% |

| Long-dated options (>30d) | 65% | 25% |

| Retail option ADV | ~15M | ~30M |

| Avg. 0DTE trade size | ~4 contracts | ~4 contracts |

| Electronic execution (0DTE) | ~70% | 97% |

What This Means for MajorWager Traders

MajorWager visual tools track where the biggest bets are being placed intraday. This data confirms what our edge already exploits:

- Institutionals and retail are clashing at the same intraday levels.

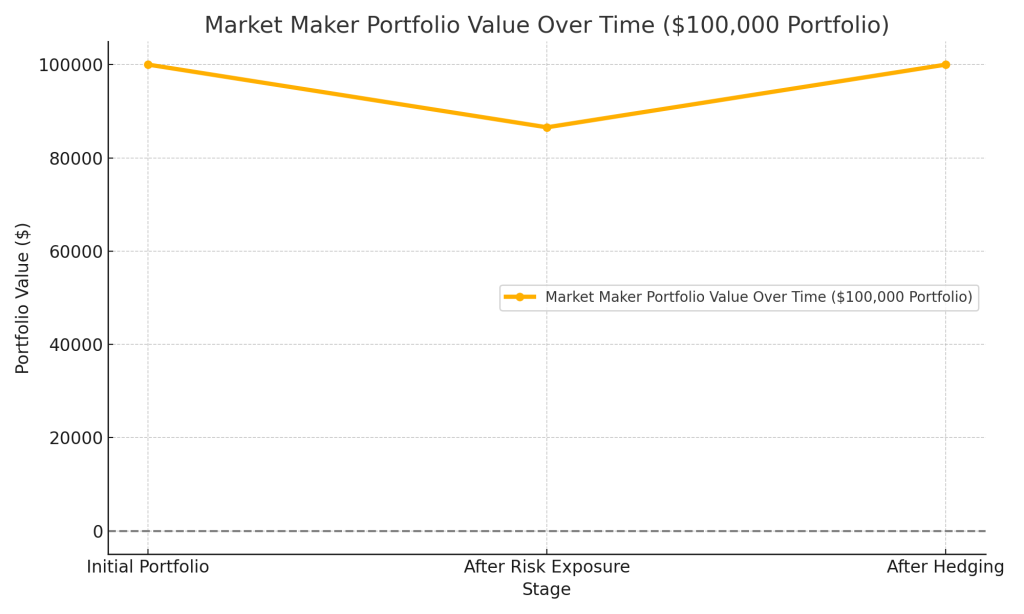

- Market Makers are forced to hedge Delta and Gamma in real-time.

- Volume plus timing plus strike equals signal.

When you see 0DTE flow stack at a level, that’s not random. That’s battle prep.

TL;DR: Hook the Whales, Ignore the Noise

The 0DTE revolution is retail-fueled, algo-assisted, and Market Maker-disrupted. But here’s the kicker: volume without context is noise.

MajorWager visual tools give you context: where, when, and why the whales move. Whether you’re scalping the morning gap or stalking a gamma wall into the close, this just validated your playbook.

Keep your eyes on the flow and remember: Inside Edge. Zero Hedge.